The Best Euro Converters for Best Buy Back Rates

How To Check You Are Getting Value for Money

Finding a good Euro Converter that will give you the mid market rate is critical when making a decision to buy back or sell a certain currency. Here we highlight the top ones to use for this purpose.

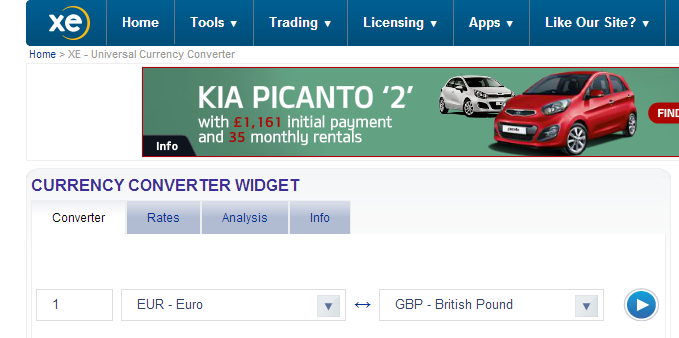

Recommendation 1: XE.com – http://www.xe.com/ucc/

This is my personal favorite and I have been using XE for over ten years now on my travels. I almost always start here because it’s accurate, it uses the live mid market rate and it’s easy to remember.

Recommendation 2: MoneyCorp – http://www2.moneycorp.com/telegraphmoney/

This currency converter is also a good shout. It’s professional, easy to use and is also accurate.

Recommendation 3: Expedia.com – http://www.expedia.co.uk/p/currency-converter

Well known travel site Expedia also has an easy to use converter that will give you an accurate mid market rate.

Important:

It’s important to note that these will give the mid market rate and not the Sell and Buy rates offered by most money changers.

Whenever a ‘Sell Rate’ is quoted this is the rate the money changer will SELL YOU that currency for one unit of the home currency. For example, a sell rate for Euros of 1.1945 means that £1 GBP will get you 1.1945 Euros.

The BUY RATE on the other hand is how much (expressed in £GBP) they will BUY Euros from you. For example a SELL RATE of 1.3319 means that 1.3319 Euros = £1GBP. In other words the BUY RATE is the BUY BACK RATE for Euros (in this example) and to calculate this you need to divide the amount of Euros by 1.3319. In this example you will get back only £75 for 100 Euros.

Many people get confused over this thinking that 1.3319 is a higher amount so it’s a better rate – in fact the opposite is true. A simple way to remember this is always BUY HIGH, SELL LOW, in other words, the lower the money changers ‘Sell rate’, the better.

The Round Trip Test

A good way to check whether you are getting value for money is to work out how much of a certain currency you can get for your money. Then take that figure and work out how much of your home currency you would get back if you exchanged it straight back to your home currency, a round trip currency transaction.

No1 Currency Screenshot as of 13th December 2013:

See the Round Trip example below using rates from No1 Currency site as of 13th December:

Exchange rate at 13th December 2013 for Euros – Buy Rate: 1.3379, Sell Rate: 1.1945

1. I have £100 and I want to buy Euros so I use their Sell Rate of 1.1945 which means I get 119.45 Euros back

2. Now, say I changed my mind and no longer want Euros, so I want to sell my Euros back to No1 Currency. I take my 119.45 Euros and using their Buy Rate of 1.3379 I get back £89.28

In other words I just GAVE AWAY £10.72 of my £100 just for changing currency.

No1 Currency are by no means the worst on the market believe me, but even so a spread of almost 10% is a lot of money for just changing your currency. Some traders will leave you over 20% out of pocket using the round trip test. Try them out using the Round Trip test and see for yourself. Imagine your work abroad and get paid in foreign currency, this would soon amount to hundred of pounds you are just throwing away.

I hope that helps understand the murky and confusing world of buying and selling currency.

Until next time … just remember … it’s your money, don’t give it away for nothing.

PS: Remember to check out the great buy back rates we give when changing leftover foreign currency or your cash foreign currency.